Of those states taxing wages, nine have single-rate tax structures, with one rate applying to all taxable income. Eight states levy no individual income tax at all. Forty-one tax wage and salary income, while one state-New Hampshire-exclusively taxes dividend and interest income. Their prominence in public policy considerations is further enhanced in that individuals are actively responsible for filing their income taxes, in contrast to the indirect payment of sales and excise taxes.įorty-two states levy individual income taxes. Individual income taxes are a major source of state government revenue, accounting for 38 percent of state tax collections.

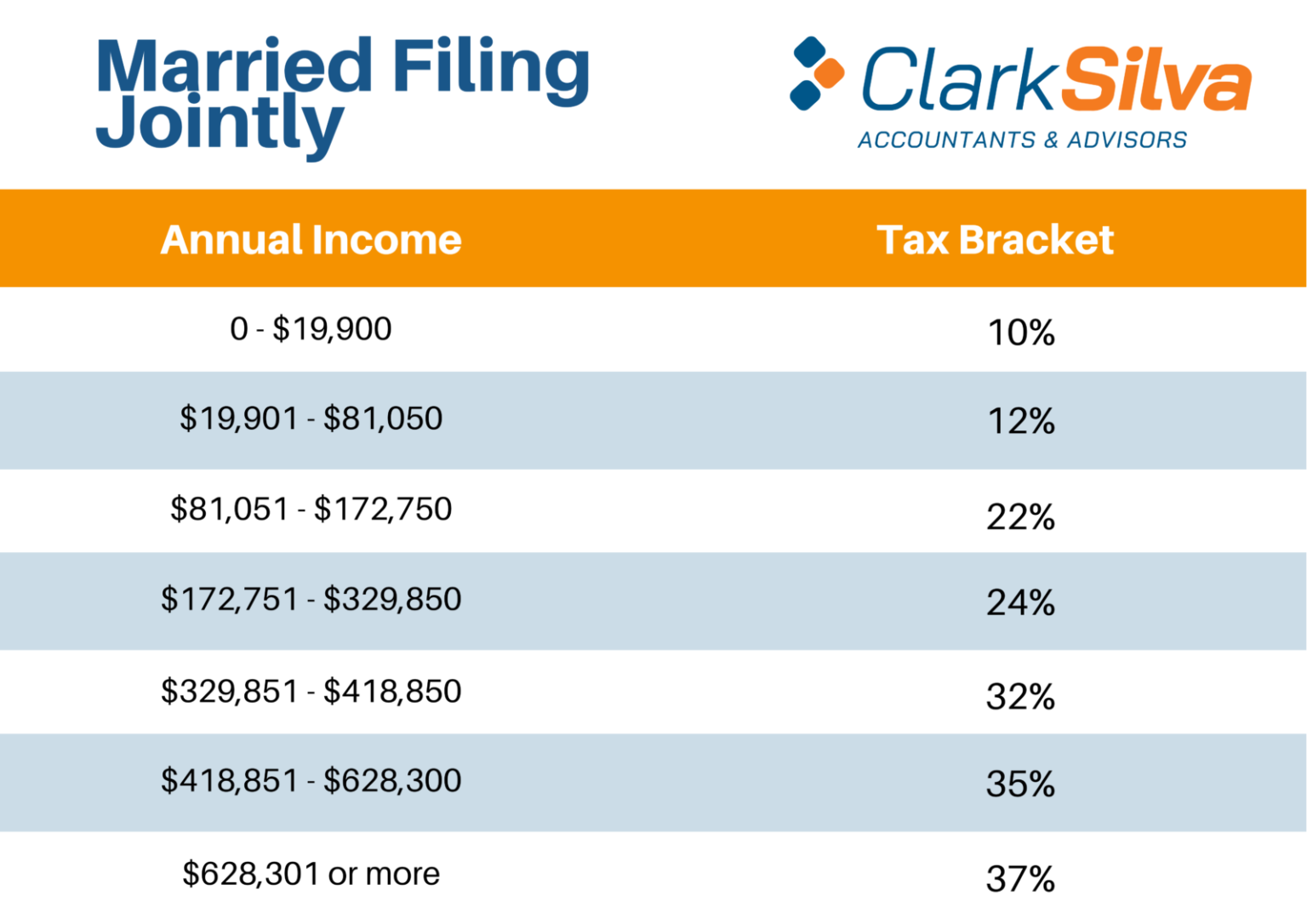

Some states tie their standard deductions and personal exemptions to the federal tax code, while others set their own or offer none at all. Some states double their single-bracket widths for married filers to avoid a “ marriage penalty.” Some states index tax brackets, exemptions, and deductions for inflation many others do not.

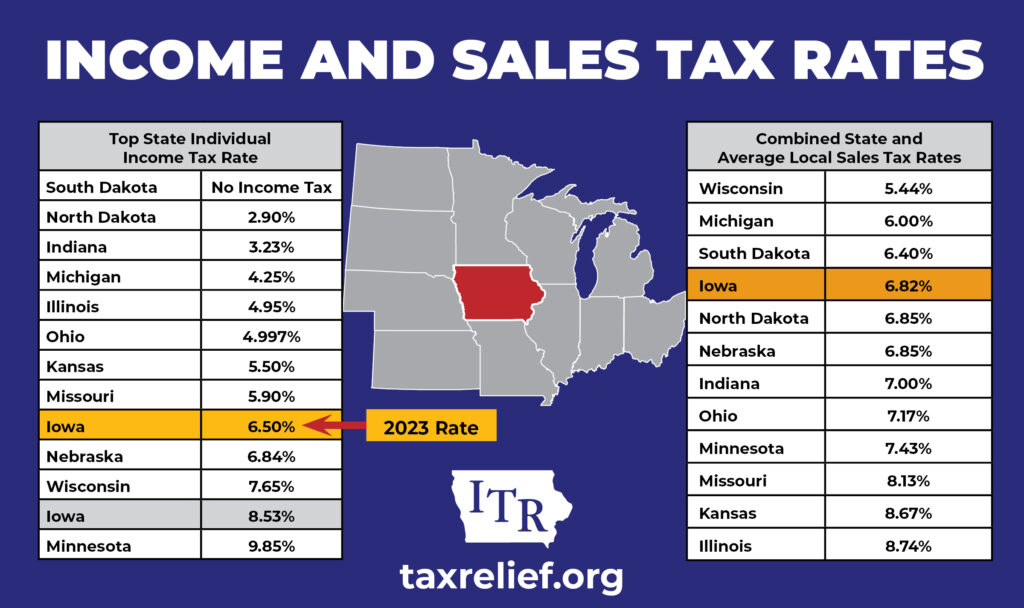

Finally, Louisiana also has a lower income tax rate of 1.85% to 4.25%. Ohio has the second-lowest rates at 2.76% to 3.99%. The tax rates in this state fall between 1.1% and 2.9%. Other than the states that do not levy an individual income tax, North Dakota has the lowest income tax rate in the nation. States with maximum income tax rates of at least 5% but less than 6% are Rhode Island, New Mexico, Idaho, Georgia, Maryland, Virginia, Kansas, Alabama, and Mississippi. States with maximum state income tax rates of at least 6% but less than 8% include Wisconsin, Maine, Washington, Connecticut, Montana, Nebraska, Delaware, South Carolina, West Virginia, and Iowa. Other states with income tax rates that exceed 8% include New Jersey, Vermont, Minnesota, Massachusetts, Washington D.C., New York, and Oregon. The lowest income tax bracket in Hawaii is 1.4%. The next highest income tax rate is found in Hawaii, where the highest bracket has a rate of 11%. The lowest tax bracket in California is 1%, which is one of the lowest in the nation. The state with the highest income tax bracket is California, which has a maximum tax rate of 13.3%. It is important to remember that this data is subject to change over time but is accurate as of March 2023. Some states have different brackets for married and single tax filers.įor the purpose of this article, we’re going to take a look at the latest marginal individual income tax rates as of 2023. For example, some states have their own deductions and exemptions, others use rates based on the federal tax code, while other states don’t allow any deductions or exemptions. These aren’t the only differences among the states when it comes to income taxes, either.

0 kommentar(er)

0 kommentar(er)